Estimated Read Time: 7-10 Minutes

Key Takeaways from this article:

- Nearly 70% of Texas business owners are operating without an updated estate plan, putting both their personal and business assets at significant risk.

- A robust estate plan for business owners requires four core documents: a Last Will and Testament, a Living Trust (either revocable or irrevocable), a Durable Power of Attorney, and a Buy-Sell Agreement – each serves a distinct purpose in protecting business continuity and asset transfer.

- The implementation of a business estate plan should follow a structured timeline, from immediate actions (7 days) to long-term annual reviews, making the process more manageable for busy business owners who might otherwise feel overwhelmed by the task.

- Only 29% of business owners have a complete, current estate strategy despite 93% acknowledging its importance – this disconnect between awareness and action represents a significant gap in business succession planning that needs to be addressed.

Silverleaf Legal is here to serve every family, no matter the shape or size. When it comes to estate planning, our dedicated team focuses on your unique goals, helping you create a plan that protects your loved ones and preserves your legacy. At Silverleaf Legal, we guide you through the process with care, clarity, and a commitment to eliminating unnecessary stress, empowering you to turn over a new leaf for your family’s future.

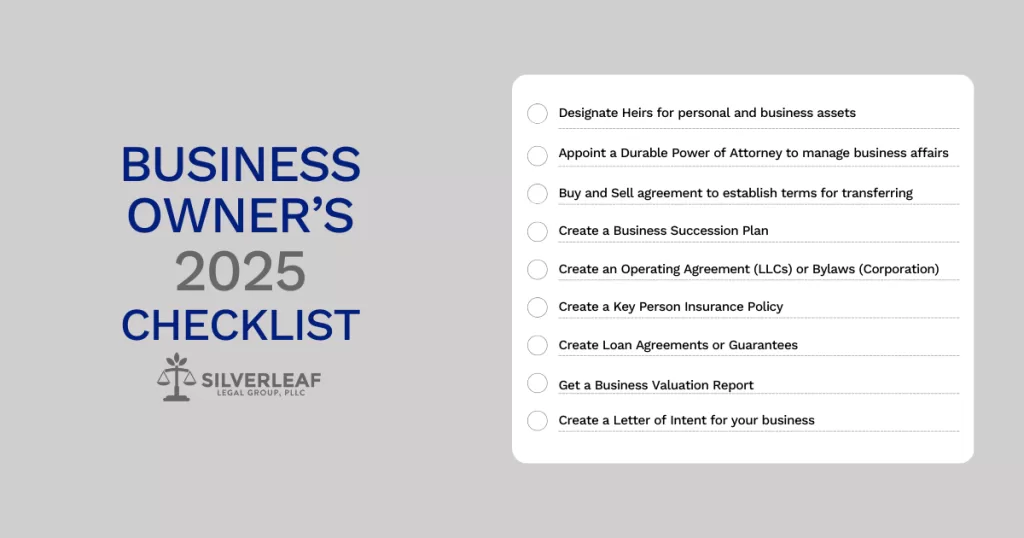

A step-by-step checklist to protect your business legacy

Here’s a shocking stat:

I discovered this while helping a Cedar Park business owner with succession planning last month.

As a small business owner myself, I know firsthand the unique challenges we face in Central Texas when it comes to protecting what we’ve built.

Let’s fix that.

This comprehensive guide will walk you through exactly what you need to secure your business legacy, whether you’re running a family business in Georgetown or managing a growing enterprise in Round Rock.

Part 1: The Core Documents You Need

Every business owner dreams of building a lasting legacy, but here’s a sobering reality: 70% of family businesses don’t survive the transition to the second generation. The difference often comes down to proper planning and documentation. Whether you’re running a thriving tech startup in Austin or a family restaurant in Houston, these four essential documents will help protect everything you’ve built and ensure your business thrives even when you’re not at the helm.

Here are the essential documents every Texas business owner must have:

1. Last Will and Testament

Your will is the foundation. Here’s what it needs to include:

- Clear designation of heirs for both personal and business assets

- Named executor who understands your business

- Specific instructions for business asset distribution

Pro tip: Don’t use a generic template. Your business requires custom provisions.

2. Living Trust

This is crucial for avoiding probate (which can freeze your business operations).

Two options:

- Revocable Trust: Maintain control while alive

- Irrevocable Trust: Better tax benefits, less control

The trust should include:

- Detailed instructions for business management if you're incapacitated

- Clear succession plan

- Tax optimization strategies

3. Durable Power of Attorney

This document is your business’s lifeline if you’re incapacitated. Include:

- Named agent with business experience

- Specific powers for business operations

- Backup agents

4. Buy-Sell Agreement

Think of this as a prenup for your business. It should cover:

- Triggering events (death, disability, retirement)

- Valuation methods

- Funding mechanism (usually life insurance)

- Transfer terms

Part 2: Business-Specific Documents

Your estate plan’s core documents are your foundation. But, your business needs its own, specialized protection.

Consider this: Walt Disney died unexpectedly at 65. His brother Roy delayed retirement to spend five years executing Walt’s detailed succession plans. They turned Walt’s dreams into the empire we know today. Your business deserves the same level of dedicated planning. These business-specific documents work alongside your estate plan to ensure your company doesn’t just survive a transition, but thrives through it.

Business Succession Plan

This is where you get specific about the future of your business:

- Named successors

- Training requirements

- Timeline for transition

- Financial arrangements

- Performance metrics

- Operating Agreement/Bylaws Update

Your governing documents need estate planning provisions:

- Ownership transfer procedures

- Decision-making during transitions

- Rights of heirs

- Buy-out procedures

- Key Person Insurance

This provides vital cash flow if you or another key person dies:

- Death benefit sized to business needs

- Clear beneficiary designations

- Regular policy reviews

- Cross-purchase vs. entity purchase structure

Part 3: Tax Strategy Documents

The most expensive document is often the one you don’t have—especially when it comes to taxes.

Just ask the Hobby Lobby family, who saved millions through careful tax planning, or the countless Texas business owners who’ve lost up to 40% of their business value to unexpected federal estate taxes. While Texas may be tax-friendly, Uncle Sam isn’t always as generous. These documents aren’t just paperwork—they’re your business’s shield against unnecessary taxation and the key to maximizing your legacy’s value.

Estate Tax Strategy

Texas has no estate tax, but federal estate tax can hit hard. Include:

- Valuation discount planning

- Gifting strategy

- Trust structures

- Life insurance planning

- Business Valuation

Get this done now. Include:

- Professional valuation report

- Regular updates

- Method for future valuations

- Industry benchmarks

Part 4: Implementation Steps

Having the right documents is only half the battle—executing your plan is where many Texas business owners stumble.

Among the 30% of business owners without an estate plan, half of them have not done the planning because the topic is very hard to deal with. Don’t let perfect be the enemy of done. Here’s your practical, step-by-step roadmap to get your estate plan in place without overwhelming your already busy schedule. By breaking it down into manageable chunks, you can protect your business’s future without disrupting its present.

Here’s your action plan:

1. Immediate Action (Next 7 Days):

- Gather existing documents

- List all business assets

- Create emergency contact list

- Schedule professional consultations

2. Short-Term (30 Days):

- Draft core documents

- Review insurance coverage

- Begin succession planning

- Update operating agreement

3. Medium-Term (90 Days):

- Finalize all documents

- Fund trusts

- Implement tax strategy

- Train key personnel

4. Long-Term (Annually):

- Review all documents

- Update valuations

- Adjust insurance coverage

- Revise succession plan

Common Mistakes to Avoid

Even the most thoughtful business owners can stumble when planning their legacy. Take the cautionary tale of a prominent Dallas family business that unraveled after three generations simply because their estate documents hadn’t kept pace with their company’s growth. While estate planning mistakes are common, they’re not inevitable. These are the critical pitfalls that have derailed even the most successful Texas enterprises—and more importantly, here’s how to avoid them.

1. DIY Estate Planning

- Business assets need specialized planning

- Tax implications require expertise

- State-specific laws matter

2. Outdated Documents

- Review annually

- Update after major changes

- Keep funding current

3. Poor Communication

- Tell key stakeholders the plan

- Train successors early

- Document everything

Next Steps

The difference between a business legacy and a business burden often comes down to timing.

Research shows that 50% of business owners say they’re too busy running their company to focus on succession planning—until it’s too late. Your business’s future shouldn’t depend on chance or rushed decisions.

You’ve taken the crucial first step by reading this guide. Now let’s turn that knowledge into action that protects everything you’ve built.

Don’t let your life’s work become someone else’s burden. Take action today:

- Schedule a consultation with an estate planning attorney who specializes in business succession

- Gather your current documents and business information

- Make a list of questions and concerns specific to your business

- Share this guide with your business partners and family members

Remember: Your dedication to building your business deserves the same level of commitment when it comes to protecting its future.

Want personalized help protecting your business legacy? Reply to this email or call [phone number] to schedule a consultation.

Your family, employees, and business partners will thank you for having the foresight to plan ahead.

A: As a general rule, you should review your business estate plan annually. However, certain events should trigger an immediate review, including: changes in Texas business laws, buying or selling major business assets, changes in your family structure (marriages, divorces, births, deaths), or significant shifts in your business structure or value.

A: Yes. While your personal estate plan is important, your business requires specific provisions that address unique challenges like operational continuity, employee retention, and business valuation. The Texas Estates Code grants executors certain powers over business interests, but without proper business succession planning, your executor may lack the authority or knowledge to make critical business decisions during the probate process.

A: Without proper planning, your business could face serious operational and legal challenges. Under Texas law, the court would need to appoint a guardian to manage your affairs, which can be a lengthy and expensive process. During this time, your business might face frozen accounts, interrupted operations, and difficulty making crucial decisions. A comprehensive estate plan with a Durable Power of Attorney and proper succession planning can help avoid these issues and keep your business running smoothly.